Sales and discounts are one of the most common marketing strategies used by retailers and yet consumers rarely wonder, “why now?” before reaching for their wallets. In fact, there is an entire subset of data analytics dedicated to exploring cycles of price fluctuation in e-commerce and in brick-and-mortar stores.

In a video released today by the Center for Business and Economic Research, Jin Huang, Visiting Assistant Professor of Marketing at NYU Shanghai explains how she applies economic theories to price reduction data. “There is a seemingly simple explanation for pervasive price reductions...that they are results of random variations in inventory holdings or demand, or well-publicized sales such as Black Friday in the US or the Singles Day eCommerce Holiday in China,” says Huang. “However, this cannot explain why price reductions are [not limited to these dates], and often periodic.”

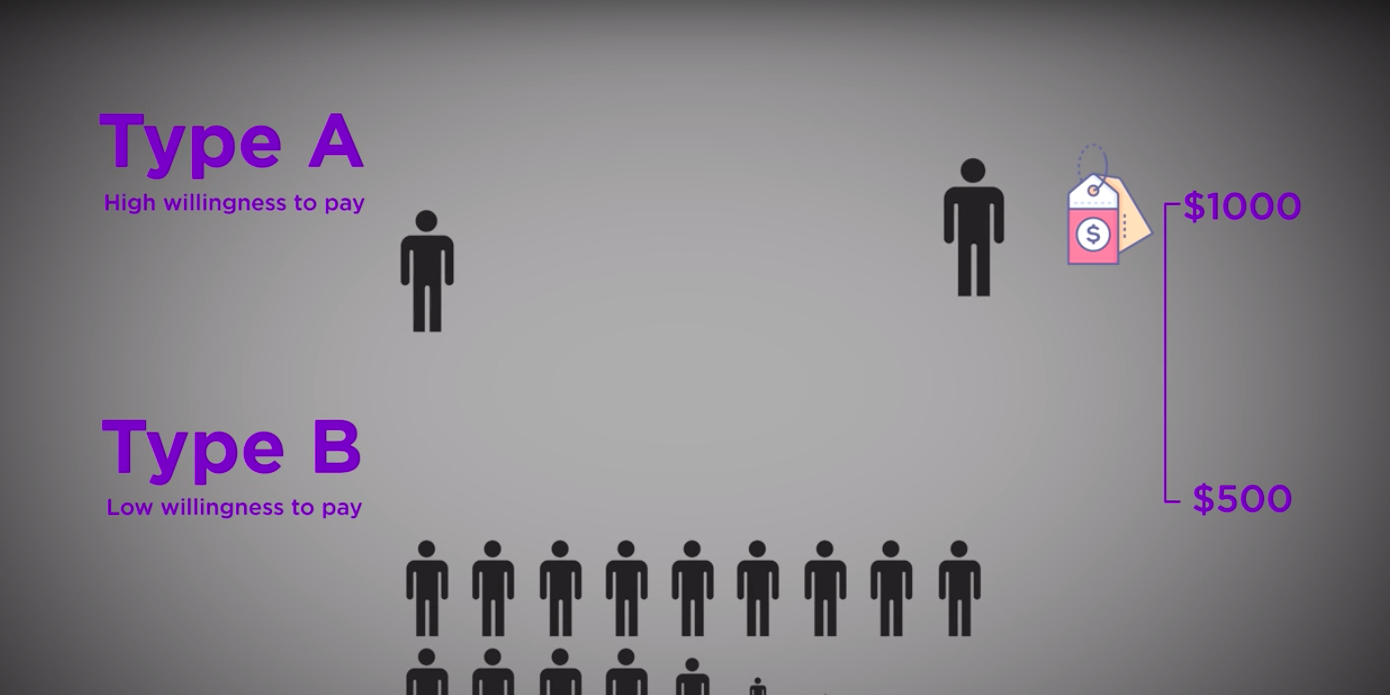

From an economic perspective, Huang asserts that periodic sales are a means of price discrimination by sellers. “Let us assume that a seller is facing two types of potential customers: type A consumer finds the product very desirable, while type B consumer finds it appealing. But type B consumer is willing to pay less than type A consumer,” says Huang. “Therefore, most of the time, the seller charges a high price so that type A consumer buys immediately and type B consumer waits.”

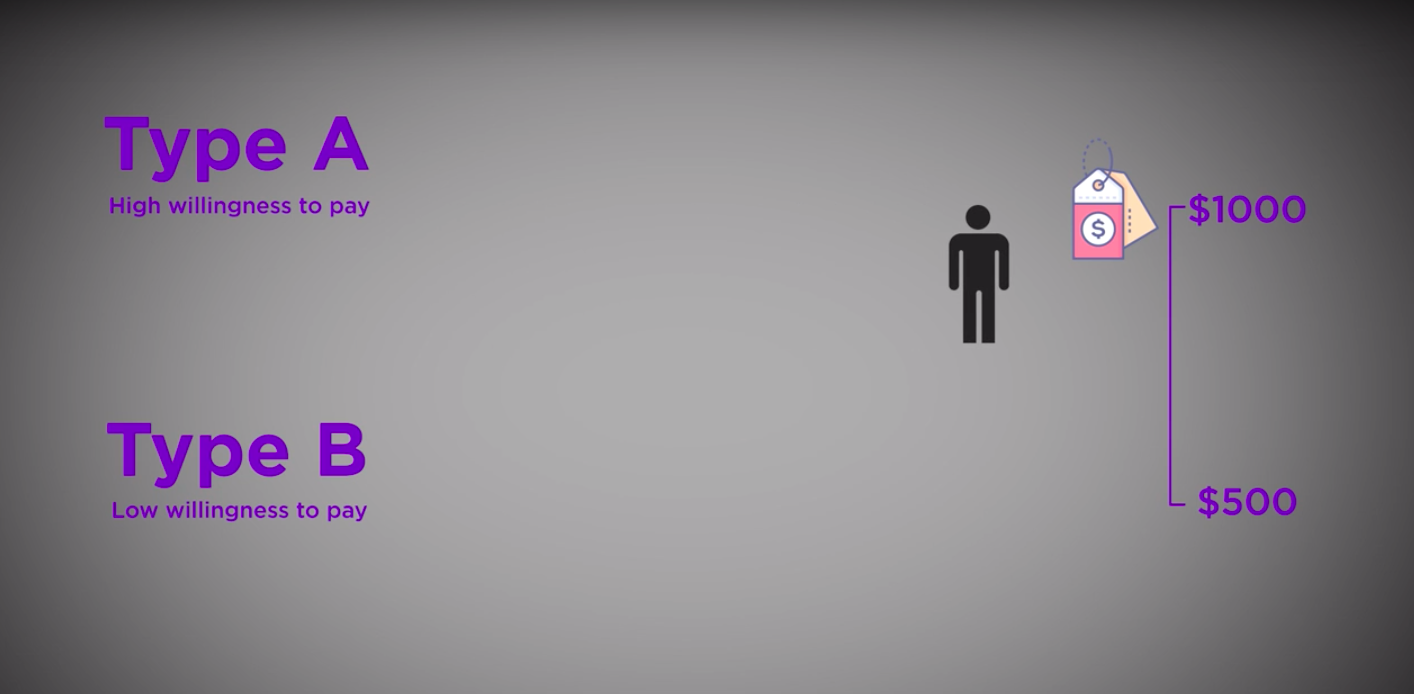

Type A consumers buy the product immediately at a high price while type B consumers wait.

Type A consumers buy the product immediately at a high price while type B consumers wait.

As type B consumers accumulate to a certain amount, the seller drops the price triggering mass purchases by type B consumers.

As type B consumers accumulate to a certain amount, the seller drops the price triggering mass purchases by type B consumers.

After the stock of type B consumers is cleared out, the seller will raise the price again to target purchase of new type A consumers.

After the stock of type B consumers is cleared out, the seller will raise the price again to target purchase of new type A consumers.

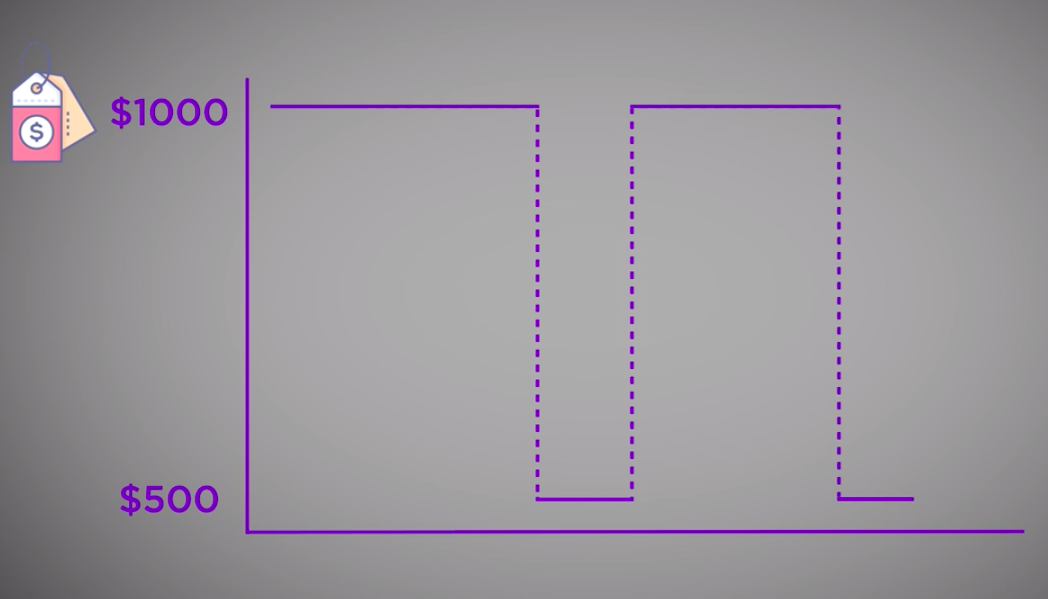

Over time, type A consumers satisfy their desire for the product by making purchases, while type B consumers wait. As a result, the pool of type B consumers accumulates, and when the seller drops the price, this triggers mass purchases by type B consumers. Once the stock of type B consumers is cleared out, the seller will raise the price again, targeting occasional purchases by new type A consumers. “Under this mechanism, the price displays a cyclical pattern,” says Huang.

Cyclical pricing pattern

“If we...track a product’s pricing history, especially the time of last sale, we can gauge for how long type B consumers have been accumulating, and use the information to predict [timing for] the next sale.”

Tracking website “Keepa,” used for keeping tabs on prices on Amazon.com.

Tracking website “Keepa,” used for keeping tabs on prices on Amazon.com.

A new slew of “price tracking” websites have appeared on the market for just this purpose. Huang says that since major online shopping platforms do not provide pricing history, these new websites are used by consumers to predict future sales. Conversely, they may also be creating pressure for sellers to lower prices or hold sales more frequently.

Professor Jin Huang is a Visiting Assistant Professor of Marketing at NYU Shanghai with a research focus on Marketing Strategy and Industrial Organization. She holds a PhD in Economics from CEMFI (Center for Monetary and Financial Studies) and is a member of the Center for Business Education and Research (CBER) at NYU Shanghai, which aims to promote innovative research on China-related business and to inspire academic collaboration among industry leaders, business faculty and students.