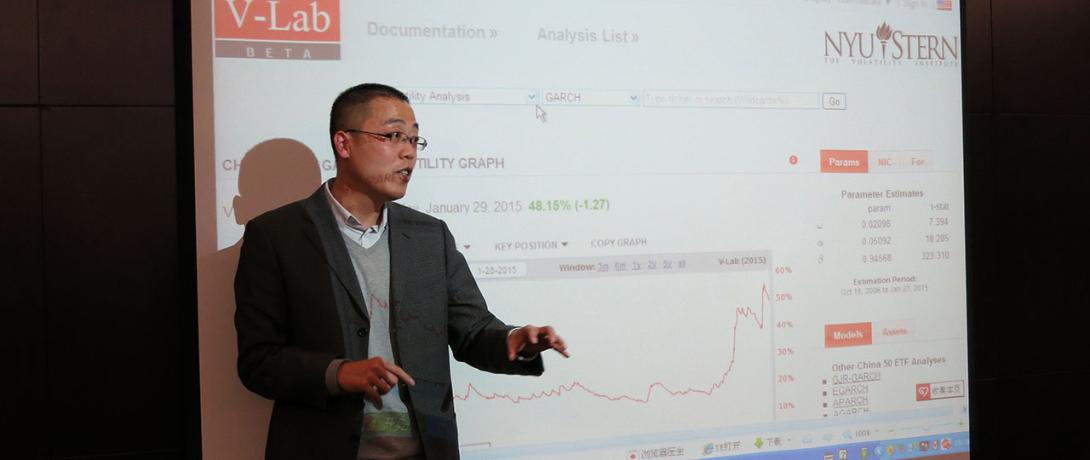

On February 5, 2015, Professor Xin Zhou (Executive Director of Volatility Institute at NYU Shanghai) delivered a lecture on risk assessment of financial assets at the Shanghai Stock Exchange Capital Market Research Institute Masters' Forum.

Welcomed by a full house of scholars and company executives, Zhou introduced the research tools and methods used by the Volatility Lab (V-lab) and further explored the applications and influences of methods in the research fields of financial volatility, correlations, systematic risk, long-term value at risk, and liquidity risk.

Since volatility is a vital variable in the research of financial economics, one of the tools that V-lab uses is the Volatility Analysis Model. Zhou discussed three specific models under this topic: the GARCH Model to describe asymmetry, the MEM Model to describe nonnegative series, and the Spine-GARCH Model to describe long-term volatility. In addition to introducing the Volatility Analysis Model, Zhou systematically presented the Correlations Analysis Model, Systematic Risk Analysis Model, VaR Analysis Model, and Liquidity Analysis Model.

Zhou then moved on to discuss practical applications of V-lab in the real world. As he stressed, the study of financial markets is a rapidly growing discipline focused on real-time measurements analysis. Combining classical models and the latest advances proposed in financial econometrics literature, V-lab collects real-time data and uses it to develop a forecast. Currently, V-lab runs 83,513 analyses on 16,895 data sets, generating a total of 140,285 series each day. It is V-lab’s aim to provide real-time market dynamics for financial researchers, regulators, and practitioners.