75 young scholars from around the world gathered from July 10 to 14 for this year’s Society for Financial Econometrics (SoFiE) Summer School. This year marks the sixth year that the Volatility Institute at NYU Shanghai (VINS) has hosted the summer school. The theme – Climate Finance – addresses the pressing challenges for the global economy posed by climate change.

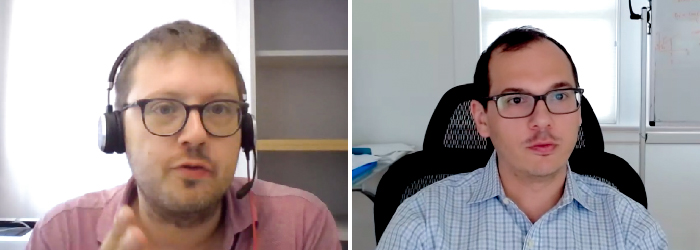

The week-long summer school provided an in-depth exploration of climate risk and its economic implications. The lectures, guest speeches and discussions, led by Stern School of Business Professor of Finance Johannes Stroebel and Yale School of Management Professor of Finance Stefano Giglio, covered various aspects, including modeling, measuring, pricing, and hedging the physical and transition risks associated with climate change, extending the analysis to markets such as stocks and housing.

Left: Professor Johannes Stroebel; Right: Professor Stefano Giglio

The choice of Climate Risk as this year’s theme was rooted in the growing recognition of the reality and gravity of climate change, said NYU Vice Chancellor Jeffrey Lehman. In his opening remarks, he stressed that “governments and private firms have come to terms with the reality of climate change and the potential disruption it could cause to energy markets, asset values, and even entire financial systems.” Lehman said that for finance scholars, studying climate risk is crucial to manage and understand the financial dimensions associated with this global challenge, including risk management, pricing, and even investment opportunities.

“This year’s SoFiE Summer School on Climate Finance was an enlightening and inspiring experience for all involved,” said Zhou Xin, executive director of VINS. He added that the summer school hoped to increase public awareness of climate risk, foster scholarly collaboration, and assist institutions, investors and policymakers in understanding climate change-related risks,

The summer school catered to PhD students and junior faculty, as it not only provided an overview of the growing literature in climate finance, but also offered comprehensive discussions on existing research and future research directions. Participants had the opportunity to present their current research and receive constructive feedback from instructors and fellow attendees.

This year’s participants represented an exceptional cohort from prestigious universities worldwide, including Cornell University, University of Cambridge, Kellogg School of Management, Northwestern University, and Tsinghua University. The diverse backgrounds of the students, who came from Europe, North America and Asia, enriched their learning experience, as they engaged with experts in the field and connected with their peers.

At the conclusion of the five-day course, Professor Stroebel and Professor Giglio encouraged students to consider working on impactful papers related to climate finance and biodiversity risk, and emphasized the far-reaching applications of climate finance across various areas of finance. They urged the students to use climate finance to address social problems and make a difference.