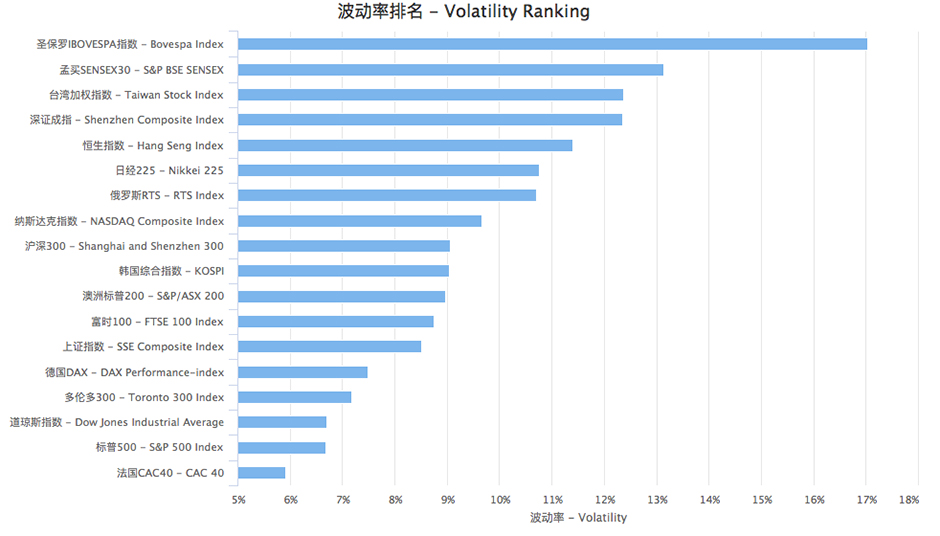

Despite the rapid growth of China’s economy, the Shanghai Stock Market has had a roller coaster ride since its launch in 1990. With investors often lacking information about the market’s risks, understanding the dynamics that feed its fluctuations has become a key area of financial research.

“Chinese influence in the world has gone up since the market crashes of 2008 affected the US and West so drastically, and there has been a greater need to study the risk of the Chinese markets,” says Professor Jianye Wang, managing director of China's Silk Road Fund and professor of economics at NYU Shanghai.

Wang founded the Volatility Institute at NYU Shanghai in 2014 with Professor Robert Engle, one of the world’s experts on the study of volatility and professor at NYU’s Stern School of Business.

Engle received the Nobel Prize in Economics in 2003 for the research behind his ARCH model, which uses a statistical approach to measuring risk and forecasting it. Following the 2008 crisis, Professor Engle launched the Volatility Institute at NYU Stern to increase access to information about market risks. Its V-Lab uses ARCH plus other mathematical models to provide real time measurement and forecasting of financial volatility and makes these models publicly available on the V-Lab website.

Building a similar center of expertise for the Chinese market was a logical next step.

“We needed to promote empirical-based research of China’s financial markets, and it made sense to link Shanghai as a financial center with NYU’s expertise in studying volatility,” Wang said.

Volatility Insights

After NYU Shanghai’s Volatility Institute (VINS) launched in November 2014, Robert Engle and Xin Zhou, the new institute’s executive director, began adapting the V-Lab’s model to the China context.

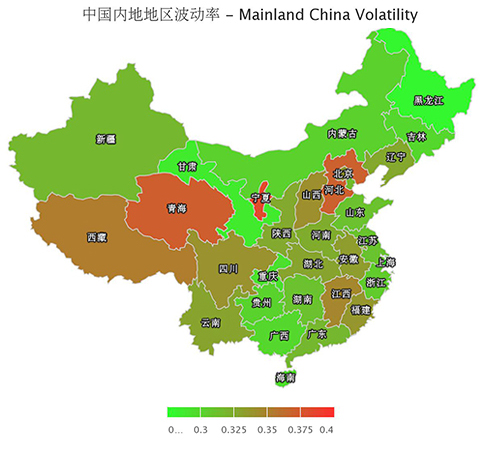

The online user interface, called VINSIGHT, provides daily volatility analyses for major stock indices and stocks across different regions, industries and types. The quantitative models driving VINSIGHT not only include historical volatility, but also “realized volatility” and “implied volatility,” which incorporate high-frequency data throughout the day.

Thanks to VINSIGHT, not only academics, but also Chinese investors and anyone in the world with a mobile phone can now quickly see data about the risks within China’s financial markets.

The Volatility Institute’s reputation for providing accurate data also quickly attracted the attention of government regulators. In 2015, the Shanghai Stock Exchange called on the VINS team to help price the first options offered on the Exchange. With no pricing history, the market required an estimated volatility in order to set the price. Using the ARCH model's predictions, Robert Engle and Xin Zhou were able to make recommendations that turned out to be very close to the actual initial price.

A Model for All

Undergraduate students at NYU Shanghai also benefit from the Institute’s expertise. Its Research Assistant program selects 10 students per year to work on projects that range from applying the China volatility index to hedging, analyzing the relationship between volatility and option pricing, and evaluating the Shanghai-Hong Kong public markets link. “This exposes them to real-world research,” says Zhou. “It is very challenging work.”

Professor Zhou also teaches an introductory class on “Chinese Financial Markets”, which explains the intricacies of the Chinese financial system, how it differs from the U.S. and how the banking sector, the stock market, and the bond market operate. “This is the most useful class I’ve taken in college,” says junior Lou Demetroulakos, “I’ve loved living in Shanghai but it wasn’t until I took Professor Zhou’s class that I realized this is the place to be.” Where else can you discuss which airlines stocks to buy with your taxi driver on your way to a class where you debate the challenges of a market dominated by speculators?

Tracking the Herd

The powerful influence of individual investors in China, and how they love to share ideas and often trade based on what their friends are doing, is the subject of Zhou’s recent research in a joint project with the China Financial Futures Exchange.

“The herding effect increases the volatility,” says Zhou. “Investors don’t want to get left behind.”

This affirms the need to make the risk data publically available and keep the VINSIGHT user interface simple enough for individual investors.

Professor Zhou says VINS will continue to help China’s markets to develop by expanding the range of data that is included in its models, and providing an academic perspective on risk.

“I hope that VINS becomes the first place that investors, scholars, regulators think of when they search for volatility-related information in China’s financial markets.”

---

By Eleanor Williamson

The Volatility Institute at NYU Shanghai holds its Third Annual Conference on Nov 17. Robert Engle, 2003 Nobel Laureate in Economics and Jiang Wang, Mizuho Financial Group Professor at MIT will give the key note speeches. See the full program

For more information about The Volatility Institute at NYU Shanghai and the VINSIGHT index, visit research.shanghai.nyu.edu/vins